The seemingly never ending struggle… let’s talk about it a bit more. Let me tell you, it takes time, and patience, and will power. All things that I wish I was better at! We all want instant, and with debt, it just doesn’t happen.

In Part 1 I left everyone with a few questions to answer, and in Part 2 I wanted to follow up on what exactly I would do with them. Everyone is different in how they approach these problems, but I’m hoping that offering one solution may lead to a solution of your own!

Here are the questions I left you all with;

- What is the amount you bring in every month? After taxes, before any expenses.

- What is your total debt. List all of the credit cards, loans, etc… out, with the highest interest rates marked as #1

- List out all of your monthly expenses

- List out large sums of money that will go out on an irregular basis (for example, in Georgia I pay about $300 a year for my car registration) and the dates you need to pay them by

- List out your savings amounts

- Finally, if you have anything you are saving up for, write it down! Everyone needs a goal. One of my big dreams is to get debt free by next year and to go on a backpacking trip in Europe during off-season (making it cheaper and getting the opportunity to interact more with locals)

Today, I’m going to take you through the Excel sheet I personally use to help me set goals, know where I am, and set budgets.

If you haven’t used Google Drive yet, today is the day! It’s a great tool for storing files, creating notes and documents you want on the go, and a place to store ideas! I use it for many things, but the one that is most helpful is my “Expenses” spreadsheet.

Head to drive.google.com and it should bring you to the main drive file storage area. We are going to create a whole new spreadsheet, so click “Create” and “Spreadsheet”. A new, untitled spreadsheet will appear.

This is where ALL of your budgets come into play.

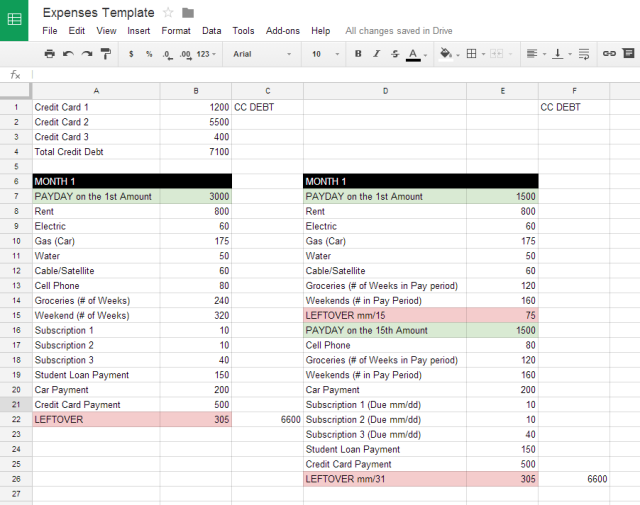

I’ve created an expenses template, listing out all expenses. I’ve been paid on both a monthly and bi-weekly basis, so I’ve included this in my template.

Based on your questions, you just fill in as appropriate! This template is great because it also shows you what is leftover. Either place this in savings, use it as some fun money, or use it to pay off additional credit card debt! Notice that in columns C and F there is also a running total of your credit card debt. This helps you see your progress. I copy and paste rows 6-22 over and over in these sheets so I can see where I am with debt and my spending over a long period of time.

Based on your questions, you just fill in as appropriate! This template is great because it also shows you what is leftover. Either place this in savings, use it as some fun money, or use it to pay off additional credit card debt! Notice that in columns C and F there is also a running total of your credit card debt. This helps you see your progress. I copy and paste rows 6-22 over and over in these sheets so I can see where I am with debt and my spending over a long period of time.

So, let’s fill this out so you are able to see what I mean. I’ve included number estimates (not my actual numbers) in here. You would need to update expenses as necessary (say you had a low or high electric bill one month over another) and your credit card debt. I am constantly checking my accounts and updating this expenses sheet!

I hope you follow this link to my expenses template, or you can create your own. I would suggest copying this to your google drive, or downloading the excel sheet if you plan to always use the same computer. I hope this helped with starting to see how to create your budgets. If in the leftover sections you are in the negatives, time to reassess! Any questions??

Pingback: Extra Money: Debt Repayment or Savings? | Where the Peaches Grow

Pingback: A Month of Mindful Spending | Where the Peaches Grow